In this article, we survey the rooibos marketplace with a view to providing a summary of the historical and contemporary market trends in South Africa and the global rooibos marketplace. Through this overview of the rooibos market, we are able to provide a clear picture of major players and factors involved in purchasing decisions in a variety of regions, and some indications of market movements.

Rooibos Marketplace Breakdown

From a historical perspective, rooibos was originally best-known and most consumed in its country of origin, South Africa, up until the early 1990s. With the end of apartheid South Africa and its agricultural products re-entered the global marketplace, and with this came a significant shift in marketplace dynamics, as rooibos became increasingly well known across the world.

Though initially sluggish as South African products began to resume supply to international markets after trade sanctions fell away, changes in the mid-90s rooibos marketplace began to develop and continue up to the present. This has seen an explosion in the export of rooibos – initially to the EU, but increasingly to other regions across the world in line with general market growth and the growing interest in herbal teas globally.

In conversations with industry players, the subsequent and generally agreed shift in the rooibos marketplace has been characterised by a ‘middle period’ in the 2000s when domestic and international consumption of rooibos was roughly at around 50/50. In recent years, the international interest in rooibos has seen this change again, to a situation where today we are in a position where exports have begun to overtake and exceed local volumes.

As of early 2022, and though this info is not readily available, the opinion of industry players leans towards exports in the rooibos marketplace to be estimated in the region of 8,000 to 9,000 tons, and domestic consumption in the order of 6,000 to 7,000 tons. This means the present total marketplace volume for rooibos is likely around 15,000 to 17,000 tons.

It is interesting to note, that by comparison, the estimated global production of black tea as a whole in 2019 was estimated at 6.1 million tons. Though rooibos production is a small fraction when compared to that of black tea, this is a changing landscape, and one in which rooibos and other herbal teas continue to gain ground.

Rooibos Consumption in South Africa

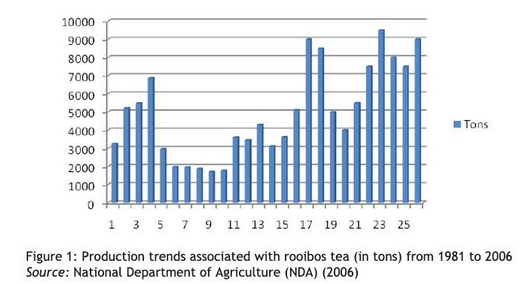

According to a published research paper on rooibos ‘The development path of rooibos tea’ (by Rampedi and Olivier, 2008), the rooibos marketplace has experienced at least three production phases:

- First development phase (1981 – 1990)

- Second development phase (1991 – 1995)

- Third development phase (1996 – 2006)

This is reflected in the following graph, showing production volumes over the period 1981 to 2006:

Over this period the factors that influenced each development phase in the rooibos marketplace were related to the scaling up of the industry (in order to establish a viable production and supply chain), seasonal patterns which affected production volumes, and quality control challenges that influenced the penetration of export markets. As the industry developed and producers improved the production and processing of rooibos, and began to implement quality controls such as the utilisation of the Hazard Analysis Critical Control Point (HACCP) system to ensure product/food safety, so the industry began to consolidate its market position.

Prior to this growth phase in the rooibos marketplace, during the 1950s until the 1980s, consumption of black tea overtook that of rooibos and until relatively recently, rooibos consumption was consistently overshadowed by black tea. Since the early years of its cultivation and consumption (ie: from the 1950s until the 1980s), rooibos was a cultural and regional staple, and was a consistent feature in South Africans’ household basket of goods. As a result of the challenges faced in importing black tea from Asian countries during the Second World War, South Africans began to consume larger volumes of rooibos. This in turn fuelled the steady growth of the rooibos industry and saw domestic consumption continue to grow, albeit largely within the limits of the South African rooibos marketplace.

Ernest du Toit, spokesperson for the South African Rooibos Council, says although black tea still has a higher overall consumption than rooibos in South Africa, it is experiencing a steady decline, whereas rooibos tea is showing growth both locally and even more so globally.

“The proportion of black tea consumers had decreased between 2011 and 2015, from 58.6% to 51.5%. However, the percentage of South African rooibos consumers increased from 29.4% in 2011 to 30.9% in 2015,” said Du Toit.

Du Toit attributes this shift in consumption behaviour primarily to the health benefits of rooibos becoming more well-known. The majority of consumers are now looking for healthier alternatives to sugar-rich carbonated beverages, and rooibos tea offers them that solution.

International Consumption

With the resumption of South African agricultural products being supplied to international markets from the mid-90s onward, international consumption has steadily grown. Influencing this growth has been the ongoing increase in interest in the global marketplace in caffeine-free specialty teas and wellness products. This market trend has enabled rooibos to enjoy a popularity that has been driven by both consumer interest as well as marketing and promotion by South African producers and large players in the international tea market.

Most rooibos is exported in bulk, in loose leaf format (i.e. approximately 95%), with the export market seeing huge growth of almost 700% between 1993 and 2003. Export volumes of rooibos tea from South Africa started to increase from 2001 to 2003 until a decline in 2004 and 2005. Rooibos tea exports volumes increased again in 2006 until a peak was attained in 2007 at approximately 5 900 tons. There was a consistent decline in total export volumes of rooibos tea from South Africa between 2008 and 2012 to lower levels of approximately 5 211 tons.

In 2014, total export volumes of rooibos tea from South Africa to the world saw a slight increase to approximately 7 057 tons, decreasing in 2015 to 6 561 – a 7% decline as compared to 2014 marketing season. This again declined in 2016 to 6 339 tons – but in 2017 exports bounced back, and showed an increase to 7 728 tons (with this representing a 21,29% increase in exports).

From 2018 to the present, the export trend has shown stabilisation and moderate growth, with figures showing exports having an approximate increase in 1 000 tons as per the figures below:

2018 – 7 700 tons (approximate)

2019 – 7 694 tons

2020 – 7 454 tons

2021 – 8 790 tons

As an indicator of growth, the comparison of 2017’s exports of 7 728 tons to the figure for 2021 of 8 790 tons shows an increase of 13,74%. This is in line with the latest estimated exports to be estimated in the region of 8,000 to 9,000 tons in a marketplace in which total production volumes are around 15,000 to 17,000 tons.

(figures quoted above are derived from published reports from the Perishable Products Export Control Board, SA Rooibos Council and Department of Agriculture, Forestry and Fisheries)

Major Export Destinations

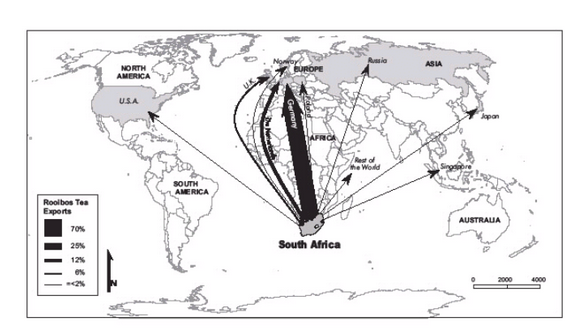

The rooibos export marketing and supply chain are dominated by a few leading European tea importer / blenders / traders based in Germany, who are the largest tea brokers in the world and buy rooibos in bulk for blending and resale to other countries.

Large volumes of rooibos are sold in bulk on annually negotiated contracts within existing relationships with global tea traders and brands. In addition, bilateral agreements take place on a case by case basis. Importantly, there is no significant market determining the price and there is generally a lack of transparency in the transactions.

Even though products like green tea have achieved enormous success in the first few years after commercial launch, long-term sustainability and growth will be determined by flavour and taste. The positive consumer reaction to the taste of rooibos thus deserves to be supported through formal taste profiling and characterisation as part of product positioning.

Another market trend in recent years has been the shift in demand towards the import of quality teas, not only in mature markets such as the UK and Russia, but also in the rest of Europe, North America and other key world markets.

Below are some insights into the largest rooibos-importing countries of Japan, Germany, the Netherlands, UK and North American markets, which are among the most significant globally.

Japan

As a well-established market for tea, Japan has consistently ranked amongst the biggest importers for many years, with the country having the highest rooibos import volumes in both 2020 (2 175 tons) and 2021 (2 556 tons).

The Japanese market is complicated and a challenge, and in such a highly competitive tea sector, any market share that rooibos manages to gain against competing beverages is thus indeed a feather in the cap for rooibos exporters. Marketing efforts in the early 2000’s started to pay off with rooibos sales to Japan growing to 581 tons in 2001, but economic recession in Japan put a damper on growth, with import volumes falling to 366 tons in 2002. Subsequent economic recovery (despite a 19-month recession as a result of the COVID-19 pandemic) has however seen a rebound in growth for rooibos in this market.

Martin Bergh, chairperson of the SA Rooibos Council, stated in a 2019 interview that “more than 2,000 tonnes of rooibos was shipped to Japan in 2018 – the largest consignment since the South African indigenous tea was first introduced to the Japanese in the ‘80s.”

In addition, and even though rooibos only makes up a tiny slice of the 200,000 tons of tea consumed in Japan per year, it is faring well above the annual 2.3% growth rate for the tea industry, clocking up a 7% increase in sales in 2018.

For additional analysis of Japan’s historical and contemporary rooibos imports, see this article in our series on importers.

Germany

Historically the largest importer of rooibos, Germany has been overtaken in recent years by Japan, with the country’s annual import volumes of rooibos decreasing from 2 139 tons in 2019 to 1 722 tonnes in 2021.

Germany has become an important market for rooibos tea because it continues to be home to the most sophisticated and experienced importers in the world tea market (Churchill and Peter, 1998). The German tea consumer market is relatively fragmented with many different companies offering a multitude of different teas, creating their own blends and flavours; while others buy the tea readily prepared to their taste.

According to the SA Rooibos Council, “In 2019, the biggest export markets were Germany (28%), Japan (22%), the Netherlands (9%) and the UK (8%).” As the (formerly) single biggest international sales channel for rooibos, Germany not only has a large influence over foreign distribution, but also some influence on pricing. It is estimated that Germany itself consumed about 60% of rooibos imported in 2020. The balance is re-sold to other buyers all over the world (with final destination untraceable) at significant profit margins.

By establishing themselves as the world’s largest brokers and blenders of herbal products, German tea buyers are expected to continue to play a crucial role in the international market positioning of rooibos within the herbal and specialty tea category.

Further information on Germany’s status as an importer of rooibos is provided in this article here on our website.

Netherlands

As the fifth-largest tea-consuming country in Europe, and having imported 1 038 tons of rooibos in 2021, the majority of opportunities in the Dutch market exist in high quality and value-added products.

As a market indicator, black tea is still the most popular tea in the Netherlands – but green tea and herbal/fruit infusions are rapidly gaining in popularity at the expense of black tea, and rooibos ranks high among the new contenders competing for Dutch sales and consumer interest. And, although historically most of the rooibos sold to the Netherlands has been in bulk, significant volumes of packed tea are also being imported.

Although imports decreased from about 30% from 740 tons in 2002 to about 500 tons in 2003, recent statistics show that exports to the Netherlands have recovered, and as of 2021, approximately 9% of total rooibos exports have the Netherlands as their destination.

For further insights into the Netherlands’ role as a significant importer of rooibos, see our article here.

UK

Having imported almost 600 tons of rooibos in 2021, and with a historical position as one of the world’s largest tea consumers, the UK’s consumption of rooibos has grown in line with global trends towards specialty teas and healthy beverages. Adding to this growth has been the consistent and ongoing marketing of rooibos to the UK consumer by a variety of longstanding and well-established tea brands to such an extent that at the present time, rooibos as a product is relatively well-known across the UK.

Dominating the UK marketplace are some of the world’s longest-established major tea brands and companies who have traded in both black tea and herbal teas for well over a century. Included amongst these, and worth a mention in the context of rooibos, is the world’s oldest rooibos brand, Tick Tock Tea, established in 1903.

As interest in rooibos has grown, so these companies (and newcomers to the UK market) have expanded their product ranges to include rooibos in various forms, including bagged and loose leaf tea, blends and, increasingly, as an ingredient in ready-to-drink beverages.

Market indicators of the shift in consumer tastes away from black tea and towards herbal teas are provided in the South African Department of Agriculture, Forestry and Fisheries’ ‘Rooibos Tea Market Value Chain’ report of 2016, which states “consumer black tea sales in the United Kingdom fell by 10.3 % between 2002 and 2010, while herbal teas increased by 50%”.

Added to this are trends that show that between 2006 and 2015, the UK saw an increase of 300% in rooibos sales and as of 2019, the UK’s consumption has seen it importing around 8% of the total rooibos production for that year, a trend that is expected to continue.

We have additional information on the UK as a rooibos importer in this article.

North America

With the USA having imported 476 tons of rooibos in 2021 and Canada showing signs of increased imports at approximately 220 tons in the same period, this is a growing area of interest for rooibos producers and exporters.

Traditionally, the North American non-alcoholic beverage marketplace has been one dominated by coffee. However, since the early 2000s and as a result of changing consumer demand, tea in general – and specialty tea in particular – has claimed a growing market share. And though initially a challenging marketplace as a result of very well-established beverage brands and companies competing for a growing slice of the explosion in interest in tea products in general, recent years have seen rooibos gaining ground in the speciality tea sector.

As a relative outlier, rooibos penetration of the US and Canadian markets has seen a significant uptick in the last 5 years, as the specialty tea market has boomed in response to consumers seeking out caffeine-free beverages which provide wellness benefits. This is a global trend that has to some extent been influenced by the repercussions of the COVID-19 pandemic, which has seen consumer interest in personal health and wellbeing become a priority, and herbal teas in general enjoy growing attention as a result.

As of 2016 specialty / gourmet teas in the US are “a growing niche market and are estimated to account for 8.5% of the US’s $2.1billion tea industry” (DAFF, 2016).

The landscape of the US and Canadian market can be considered as one trade bloc, in the sense that numerous players trade in both countries, with many products containing rooibos coming onto the market over the past decade. This is backed up by a US report that noted “62% of tea retailers increased the number of different teas sold in 2008”.

In relation to the rooibos market share of this segment, loose leaf blends and ready-to-drink products that have rooibos as a primary ingredient have seen steady growth. That said, lacklustre consumer response to the diversification of RTD tea products in the US and Canada in response to changes in consumer demand has seen many companies in this region recently scale back on their product ranges.

Nevertheless, and to a great degree as a result of rooibos’ suitability for use as a base in fruit- and berry-flavoured RTD’s, rooibos continues to gain ground. This trend is expected to continue, as demand in this market for fair trade and organic products in general grows.

Global Trends

Though the production of rooibos tea as a whole declined from an average of 20,000tons in 2006 to approximately 11,000tons in 2016, the global marketplace has continued to grow, bringing consumption to the present levels of roughly 55% for export and 45% for domestic consumption.

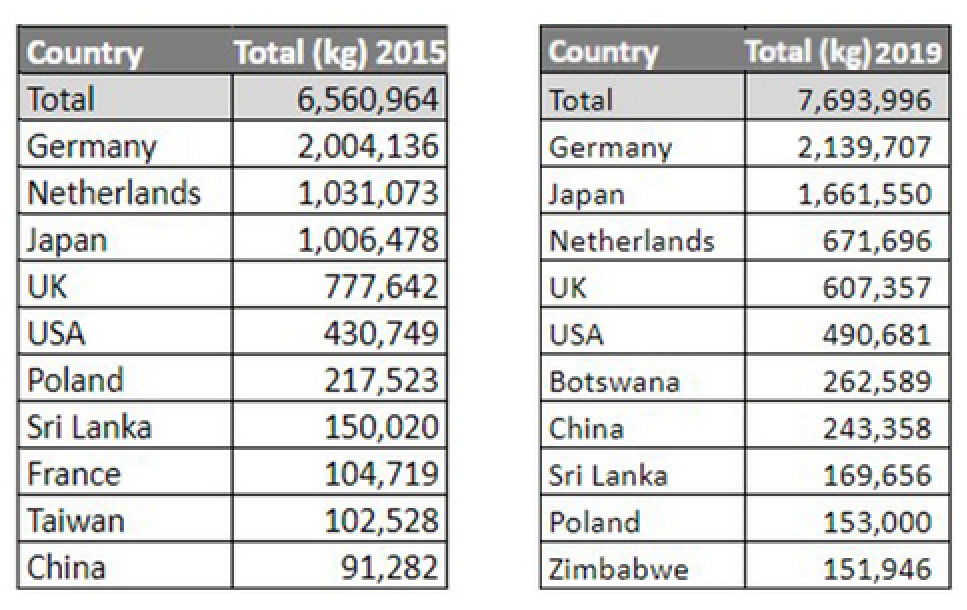

In recent years export volumes have recovered, and below is a comparison of volumes bought in the leading rooibos-consuming export markets around the world, showing volumes in 2015 and again in 2019, as an illustration of the growth in these key markets.

This data shows solid growth for rooibos exports, despite the fact that between 2016 and 2019 the rooibos growing region suffered a severe drought, which affected production and reduced output by almost 50%. This, combined with local trading dynamics, had an impact of increasing prices significantly over the period.

However, in a scenario known well to buyers and that has occurred in relation to rooibos production and pricing over the last decade, once price increased and reasonable rains returned, production climbed again and most recently in 2020 and 2021, production has come to exceed demand and prices have thus come down again.

To get insights into the role that climate change and drought have on rooibos production, take a look at the Climate Change and Irrigation page of our website.

Consumer Trends in the Rooibos Market

There is growing global interest in alternative products with high-value applications. Although most of the imports are still in bulk, a growing number of small companies import packed tea, with social media, internet and catalogue marketing playing an important role. Furthermore, rooibos is also used as a prime health ingredient in products such as iced teas, breads, jellies, chocolates, nutraceuticals and sweets. Further insights into the increase of the use of rooibos as an ingredient in a growing number of health, wellness and beverage products is provided in this article, also published here on our site.

Coupled to consumer’s interest in health and wellness is the global shift toward organic and ethically sourced products, resulting in a growing demand for organic (ie: JAS, EOS, USDA as well as other regions- and country-specific certifications) and ethical certifications such as UEBT and Rainforest Alliance. Consumers, and global tea brands, are demanding excellent traceability, organic farming and production, environmental stewardship and excellent working and social conditions for the workforce involved in the rooibos industry.

As of 2018, the increasing global demand for rooibos pushed exports up to between 7,000 and 8,000 tons per annum and the total rooibos sales in 2018 were equal to just more than 6 billion cups of tea, close to one cup per human on earth. This upward trajectory, fuelled as it is by the increase of interest in healthy living spurred on by the Covid-19 pandemic and a general trend away from high-sugar and caffeinated beverages, is expected to continue – and possibly accelerate.

As a beverage ingredient, and in terms of comparison with other organic herbal tea ingredients, the per-kilo price of rooibos sits lower or equivalent to the majority of other commonly-used herbals such as peppermint, chamomile, citrus peel and lemongrass. This, added to the well-known compatibility of rooibos with other fruit and floral flavouring ingredients, places rooibos in a favourable position as a prime contender for inclusion in the development of herbal tea and beverage innovation, and contribute to it being sought out on the global market.

What Are The Challenges of Exporting Rooibos Tea?

Increasing value adding to the exclusive benefit of South Africa as the world’s sole producer of rooibos represents an obvious challenge and opportunity for the industry.

A recent development that has generated challenges related to exporting rooibos from South Africa is the general slowdown of global logistics, as a consequence of the COVID-19 pandemic. The availability of berths in congested harbours, and a worldwide shortage of shipping containers, has also added pressure on the shipping industry, which has seen tariffs rise in response to this combination of factors. These issues are not insurmountable, and in many cases buyers of rooibos are calculating these factors into the timing and volume of their purchases in order to mitigate against stock-outs and sluggish turnaround times.

Despite these challenges, Nici Vorster, spokesperson for the SARC, suggests that growing market interest and product innovation will continue to encourage producers to manage these challenges:

“It’s not only Rooibos’ health benefits that makes it highly sought-after, but also its versatility. Apart from enjoying it as a hot or cold beverage – whether plain or flavoured, Rooibos is used in multiple other applications, ranging from beauty products and nutraceuticals to alcoholic drinks, confectionery and everyday foodstuffs, such as yoghurt and cereal. Every year, we are seeing new and exciting innovations in the Rooibos category as entrepreneurs and brands experiment with the product.”

The key takeaway from our summary is that rooibos continues to enjoy moderate growth and will more than likely continue to do so, in line with growing consumer demand for specialty and herbal teas that offer health benefits in comparison to traditional beverages such as coffee and black tea. With the industry growing at a steady measured pace and global investment trends looking good for herbal teas in general, the future of the rooibos marketplace looks positive.

We at Klipopmekaar continue to keep a close eye on the markets that are opening up for producers of organic rooibos, and welcome any buyers that may seek out premium bulk organic rooibos. If your brand or company is looking to expand your range to include organic rooibos products, feel free to contact us – we’d be happy to discuss how we could assist you.